Small Business Accountant Vancouver Can Be Fun For Anyone

Wiki Article

Some Known Questions About Outsourced Cfo Services.

Table of ContentsThe 2-Minute Rule for Tax Accountant In Vancouver, Bc10 Simple Techniques For Pivot Advantage Accounting And Advisory Inc. In VancouverGetting My Small Business Accounting Service In Vancouver To WorkWhat Does Outsourced Cfo Services Do?Outsourced Cfo Services - QuestionsNot known Details About Tax Consultant Vancouver

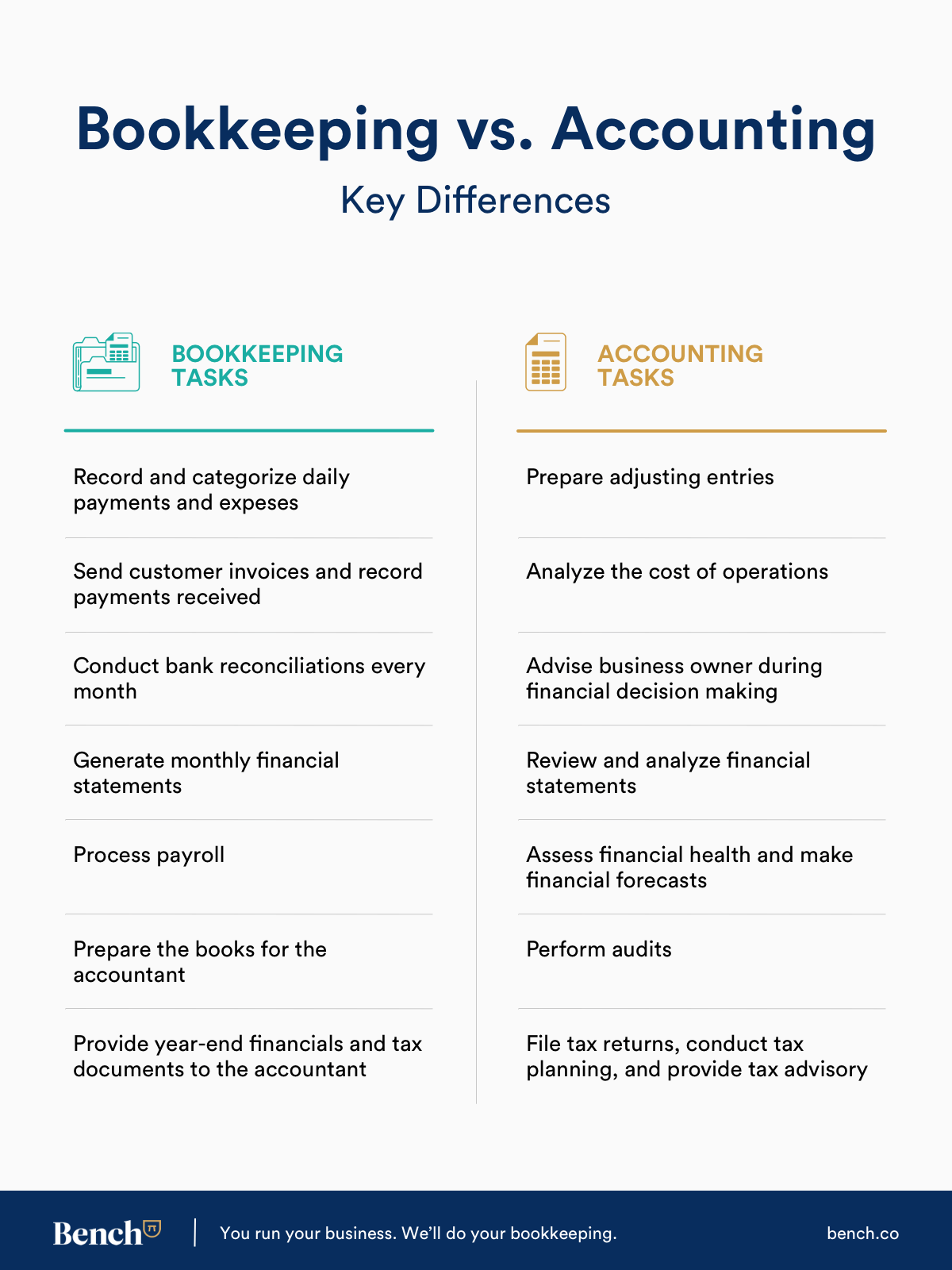

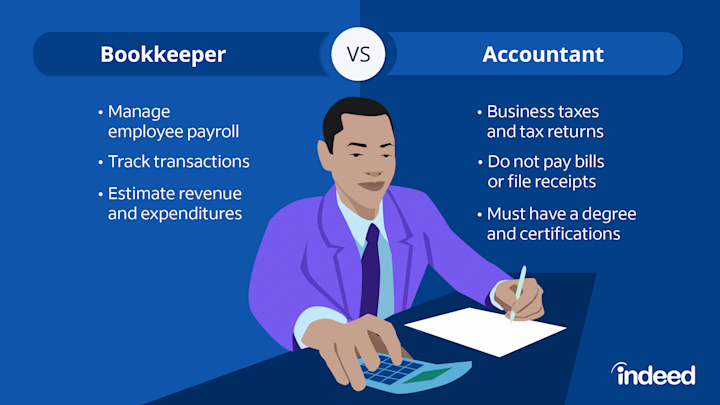

Here are some benefits to hiring an accounting professional over an accountant: An accounting professional can give you a comprehensive sight of your company's financial state, along with techniques and also suggestions for making economic choices. Meanwhile, bookkeepers are only accountable for videotaping monetary deals. Accounting professionals are called for to finish even more education, qualifications as well as job experience than accountants.

It can be difficult to evaluate the appropriate time to employ an audit expert or bookkeeper or to identify if you need one in all. While several little companies hire an accountant as a professional, you have several choices for dealing with financial tasks. Some little business owners do their very own accounting on software program their accounting professional suggests or utilizes, providing it to the accountant on an once a week, monthly or quarterly basis for action.

It might take some background research study to discover an ideal accountant due to the fact that, unlike accountants, they are not required to hold an expert certification. A strong recommendation from a trusted colleague or years of experience are necessary factors when working with a bookkeeper. Are you still uncertain if you need to hire a person to assist with your books? Here are 3 circumstances that suggest it's time to work with a monetary specialist: If your tax obligations have come to be as well intricate to take care of on your own, with multiple income streams, foreign investments, several reductions or various other considerations, it's time to work with an accountant.

An Unbiased View of Tax Consultant Vancouver

For local business, adept cash management is a crucial facet of survival and development, so it's sensible to work with a financial expert from the beginning. If you favor to go it alone, take into consideration beginning with bookkeeping software program and also keeping your publications carefully up to day. This way, need to you require to hire a professional down the line, they will have exposure into the complete financial background of your company.

Some source interviews were performed for a previous version of this post.

About Vancouver Tax Accounting Company

When it concerns the ins and outs of tax obligations, audit as well as financing, however, it never harms to have a skilled professional to rely on for assistance. An expanding number of accountants are also taking treatment of things such as cash money circulation projections, invoicing and human resources. Inevitably, much of them are taking on CFO-like duties.When it came to using for Covid-19-related governmental funding, our 2020 State of Small Service Study found that 73% of small company owners with an accounting professional claimed their accounting professional's advice was very important in the application procedure. Accounting professionals can additionally help company owners stay clear of costly mistakes. A Clutch survey of little service owners programs that more than one-third of tiny businesses checklist unforeseen costs as their top monetary difficulty, complied with by the mixing of business and also personal funds and also the inability to get settlements on schedule. Local business owners can anticipate their accountants to aid with: Selecting business structure that's right for you is crucial. It affects how much you pay in taxes, the documents you require to submit and also your individual responsibility. If you're wanting to convert to a different organization structure, it could lead to tax obligation consequences as well as various other difficulties.

Even business that are the exact same size and sector pay very various amounts for bookkeeping. These expenses do not convert right into cash, they are required for running your organization.

Vancouver Tax Accounting Company Fundamentals Explained

The average price of accountancy services for small business varies for each distinct scenario. The typical month-to-month accountancy fees for a small company will climb as you include a lot more services and also the jobs obtain tougher.You can videotape transactions and also procedure pay-roll utilizing on the internet software application. Software services come in all forms and also dimensions.

The Of Tax Accountant In Vancouver, Bc

If you're a brand-new entrepreneur, don't forget to element accountancy expenses into your spending plan. If you're an expert proprietor, it could be time to re-evaluate bookkeeping expenses. Management prices and also accountant costs aren't the only audit expenditures. virtual CFO in Vancouver. You should additionally you can try here consider the navigate to this site effects audit will certainly carry you and also your time.Your capability to lead staff members, offer customers, and also make choices can endure. Your time is likewise useful as well as must be thought about when considering audit expenses. The moment invested in accountancy tasks does not generate revenue. The less time you invest in bookkeeping and also taxes, the even more time you need to grow your business.

This is not planned as legal guidance; for more details, please click right here..

Not known Factual Statements About Tax Accountant In Vancouver, Bc

Report this wiki page